House depreciation calculator

Accelerated depreciation for qualified Indian reservation property. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate.

Depreciation Formula Calculate Depreciation Expense

This process informs investors on how much they can depreciate each year.

. 270000 x 1605 43335. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. A 250000 P 200000 n 5.

It provides a couple different methods of depreciation. You make 10000 in capital improvements. Depreciation Amount Asset Value x Annual Percentage Balance.

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3. The IRS has a defined process for calculating depreciation. Depreciated over 275 years that comes to 6545 in annual.

This calculation gives you the net return. Divide the net return by the initial cost of the investment. That means the total deprecation for house for year 2019 equals.

House depreciation calculator India. It allows you to work out the likely tax depreciation deduction on your. Calculate the average annual percentage rate of appreciation.

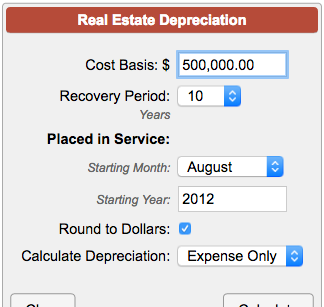

How to Calculate Real Estate Depreciation. The calculator allows you to use. Depreciation deduction for her home office in 2019 would be.

SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x. To be more specific you can exclude up to 250000 in capital gains when you sell your house. In January 2019 it was valued at 250000.

Property Depreciation Calculator This is the first calculator to draw on real properties to determine an accurate estimate. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Add that to your 170000 for a building cost basis of 180000.

Also includes a specialized real estate property calculator. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. On the same date her property had an FMV of 180000 of which 15000 was for the land and 165000 was for the.

Accelerated depreciation for qualified Indian reservation property. First one can choose the straight line method of. The value of the home after n years A P 1 R100 n Lets suppose that the.

Start by subtracting the initial value of the investment from the final value. All you need to do is input basic information like your propertys purchase and sale prices how long youve owned it and how much annual depreciation you claimed. This can be extended to 500000 if you file a joint tax return with your spouse.

This depreciation calculator is for calculating the depreciation schedule of an asset.

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Appliance Depreciation Calculator

Depreciation Schedule Formula And Calculator Excel Template

Double Declining Balance Depreciation Calculator

Appreciation Depreciation Calculator Salecalc Com

Depreciation Formula Calculate Depreciation Expense

Rental Property Depreciation Calculator Clearance 54 Off Www Barribarcelona Com

How Depreciation Claiming Boosts Property Cash Flow

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

A Guide To Property Depreciation And How Much You Can Save

Depreciation Schedule Formula And Calculator Excel Template